Purpose Index™

Purpose has positive effects on all stakeholders

Purposeful companies secure future relevance and improve their bottom line. Organizations that have established and implemented a clear purpose will benefit financially from both internal and external factors.

Customers

Being a purposeful company has a very high correlation with being the preferred supplier across B2B and B2C industries. Data also shows that it leads to significantly higher credibility and intent to buy the company’s services and solutions.

- Increased intent to buy

- Increased preference

- Increased advocacy

- Increased customer loyalty

- Increased credibility

Talent

Purpose generates a more satisfied workforce with a higher level of engagement resulting in higher productivity. It also acts as a guiding light for internal decision-making and leadership, providing strategic direction and perseverance.

- Improved employer attraction

- Improved talent retention

- Improved employee engagement

- Improved employee health

- Increased productivity

Society

Purpose-led companies that align with key future societal needs can form strong and mutually rewarding relationships with governments and societal institutions. As a valued partner to society, these companies can stay in the know.

- Proactive governmental support

- Partnerships for reskilling talent for specific industry needs

- Diminished regulatory risk

- Improved public relationship

Planet

Long-term sustainable business models anchored in purpose save money through streamlined processes and resource efficiency, limit operational and regulatory risks linked to climate change and resource scarcity, and ensure future relevance.

- Reduced operating costs

- Diminished operational risks

- Diminished regulatory risk

- Lowered capital costs (ESG)

- Improved customer and employee relationships

Shareholders

Purpose-driven companies increase shareholder value by making higher market share gains, growing substantially faster, and achieving higher innovation rates than their competitors.

- Increased market cap

- Increased earnings

- Increased growth rate

- Improved innovation and change rate

Purpose drives preference

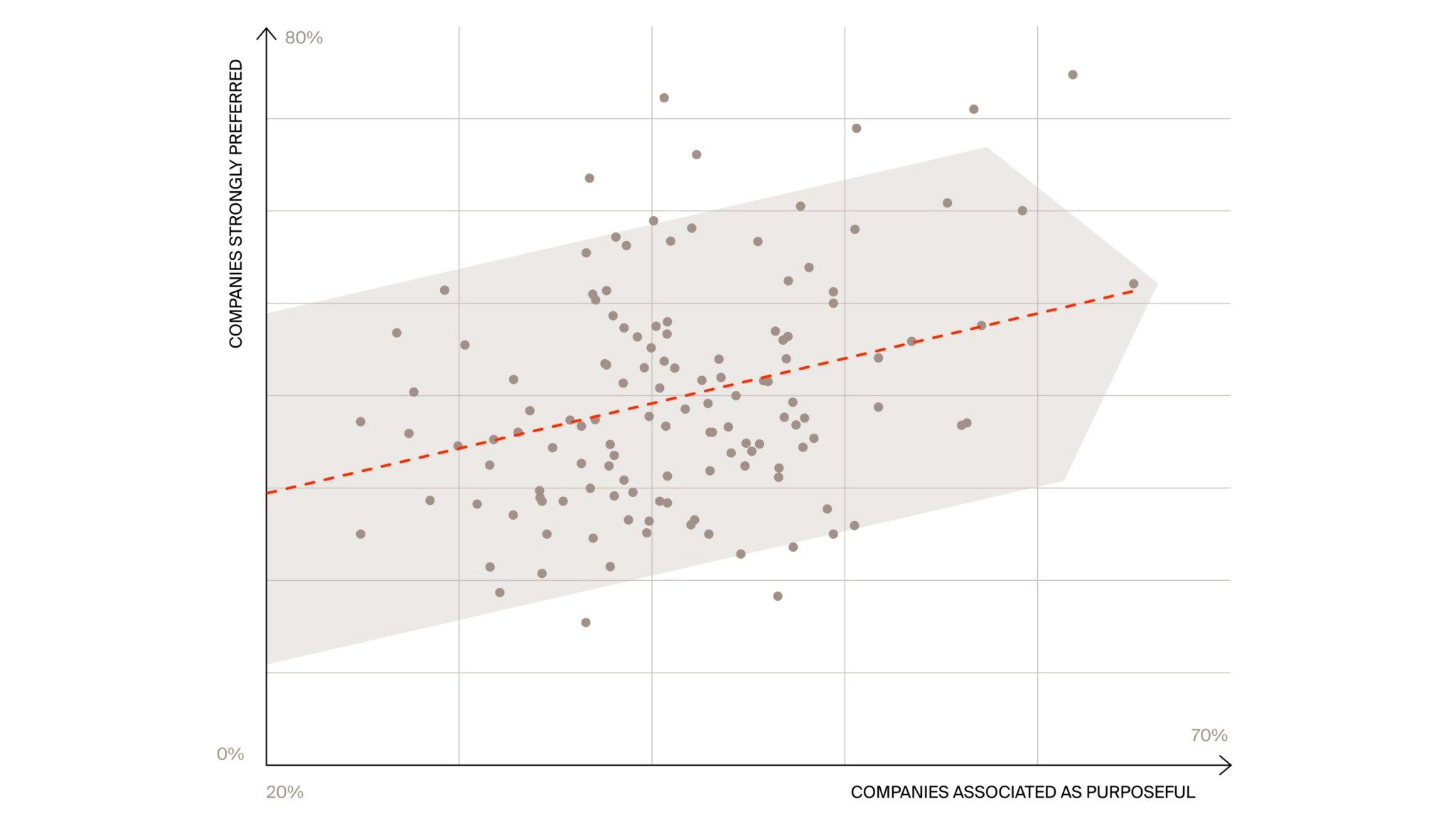

Years of data from the Lynxeye Purpose Index™ tells us that if 10 additional people perceive a company as purposeful, we can expect 6 of them to prefer it in a purchase situation. Other, non-purpose-related factors that influence preference include for example price, awareness and distribution.

Companies with higher customer preference figures are proven to experience higher market shares. High preference figures also increase customer loyalty and create more credibility, in turn positively affecting shareholder value creation.

The scatter graph on this page illustrates the correlation between purpose and preference in the United States.

Purpose correlates with financial performance

Companies’ ranking in Lynxeye Purpose Index correlates with financial performance. This can be seen among large corporations, where 47 of the companies were both measured across all markets and provide readily available financial information.

The five top ranked global companies in Lynxeye Purpose Index saw a revenue growth rate seven times higher (ix 739, +20% vs +2.7%) than other large corporations in the study. For the same five companies, market cap growth was also three times higher (ix 369, +41% vs +11%) than that of other companies. §

The top five companies were Apple, Google, Microsoft, Amazon, and Samsung. These companies’ average annual revenue growth rate was +20%, measured over a two-year period 2020 and 2021. This is in contrast to 42 companies lower on the list, with an average revenue growth of +2.7% during the same period. Market capitalization for the top five ranked companies increased +41% over the two-year period 2020-2021. The same development for 42 lower ranked companies was +11%.

Source: Lynxeye market intelligence hub, Jan 2023